The incidence of part-time work varies across demographic groups and activity sectors, and these differences may offer insights on the future evolution of hours worked per worker. Female and older workers have been two important forces driving the increase in labour force participation in the euro area. It is expected that these two groups will continue to increase their share in the labour market, in view of the large heterogeneity in their labour force participation rates across the euro area countries and the ageing of the population. These developments are likely to continue to contribute to lower hours worked per worker as these workers are more likely to work part-time. In addition, the incidence of part-time varies greatly across economic activity sectors.

For example, accommodation, healthcare and social activities, and education are three sectors where the incidence of part-time work is above average and which have also gained employment shares since the global financial crisis. An increase in employment in sectors with higher shares of part-time work may lead to lower average hours worked per worker in the future. The skill level is another factor explaining the incidence of part-time work. Part-time work increased across all education groups, with faster increases for low- and middle-skilled workers than for high-skilled workers, from about 16% in 2000 to 24% in 2020. In the same period, part-time employment among high-skilled workers increased from 13% to 18%.

The increasing employment share of high-skilled workers may moderate the downward pressure on hours worked per worker. The federal law most relevant to the distinction between part- and full-time employment is the Affordable Care Act, which requires that large employers share the financial responsibility of health insurance for full-time employees. The law defines full-time work as at least 30 hours per week or 130 hours per month.

Companies that meet the threshold for size must either offer an affordable health insurance plan to these full-time employees or pay a penalty for not offering coverage. No company, regardless of size, is required by the federal government to subsidize health insurance for part-time employees who work fewer than 30 hours per week or 130 hours per month. The Fair Labor Standards Act, which sets federal regulations for wages and overtime pay, does not make any distinction between full- and part-time workers.

Employees are covered by the law's provisions whether they work 15 hours per week or 50. According to the FLSA, no matter how many hours an employee works, an employer cannot pay less than $7.25 per hour or the applicable state minimum wage. FLSA also sets parameters for employing minors, and these rules are also not affected by whether an employee's schedule meets a minimum number of hours. Full-time employees who stay with your company for at least 12 months aren't the only ones that might need an hourly breakdown. Some companies have full-time temporary or seasonal jobs, such as an accountant who hires additional workers to help during tax season. Other companies might have part-time workers who occasionally work full-time hours, such as getting 40 hours per week when filling in for sick employees.

Depending on the reason you're calculating the hours, you might need to include these other forms of full-time hours as well. The FLSA regulates the handling of wages and hours for non-exempt employees. Typically, they are paid by the hour, but may also be salaried employees. Often, workers in construction, maintenance and services are considered non-exempt. Many employers opt to provide benefits that are not required by law, such as dental insurance and paid vacation time. For these purposes, an employer can define part-time employment in whatever way that makes sense for the business.

However, one important benefit of these perks is to contribute to employee morale and encourage workers to stay with a company. If an employer defines part-time work as anything less than 40 hours per week and doesn't extend benefits to part-time workers, the policy may create ill will, causing workers to be less likely to stay with the company in the long term. The future path in hours worked per worker is difficult to predict, while the balance of factors seems to point towards the downward trend continuing. The expected increase in labour market participation of female and older workers is likely to exert downward pressure on hours worked per worker. A higher employment share in the services sector with higher rates of part-time employment may also lead to lower average hours worked.

By contrast, the ongoing upskilling of the labour force may moderate the decline in hours worked per worker, as individuals with higher education levels tend to work more hours on average. Preferences regarding the allocation of time will continue to play a key role on the evolution of hours worked. The declining trend in average hours worked has been accompanied by an increase in the trend labour force participation rate. This is not merely a co-movement, but the two indicators are related.

The rise in the trend labour force participation rate is instead driven by women and older people being more involved in the labour market. The increase in the trend labour force participation rate has offset the negative contribution from trend hours worked per worker, albeit with differences over time. Developments in trend hours worked per worker and labour force participation also relate to the slowing growth of the working age population. The ageing of the euro area population results in an increasing share of pensioners and a worsening of the old-age dependency ratio.

This has incentivised governments to introduce pension reforms that have been the main driver of the rise in the labour force participation rate and also contributed to the decline in trend hours worked per worker. Part-time employment features a cyclical component related to "involuntary" part-time employment, which acts as a buffer in the adjustment of the labour market during crisis periods. Chart 8 shows the evolution of part-time employment in the euro area between 2006 and 2019, focusing on disentangling the trend increase in "voluntary" part-time employment from the more cyclical "involuntary" part-time employment. "Voluntary" part-time employment reflects increases in the aggregate labour supply stemming from increasing flexibility in the labour market, which allows workers to work if they wish and to work fewer hours than a full-time job.

By contrast, "involuntary" part-time employment comprises all workers who work part-time because they could not find a full-time job. In this way, involuntary part-time captures fluctuations in labour demand, in workers' bargaining power and in the matching efficiency of the euro area labour market. This all means that involuntary part-time employment is considerably more cyclical than voluntary part-time employment. Voluntary part-time employment has been trending upwards over time, without many major cyclical fluctuations. The share of involuntary part-time work can also be linked to labour underutilisation beyond that captured by the unemployment rate, with this factor instead being observed in a decline in average hours worked.

The negative relationship between hours worked per worker and part-time employment is a long-term feature of the euro area labour market. The growth rate of average hours worked is lower as part-time employment increases during both expansions and recessions. However, this relation is asymmetric with the business cycle, with changes in part-time employment having a stronger impact on the growth of average hours worked during recessions than during expansions. Table 1 proposes a set of reduced-form regressions quantifying the negative relationship between average hours worked and the share of part-time employment. An increase of one percentage point in the share of part-time employment serves to slow year-on-year growth in average hours worked by 0.12 percentage points during expansions and by 0.57 percentage points during recessions.

The cyclical conditions of the labour market are also an important factor contributing to the dynamics of average hours worked. Year-on-year changes in the unemployment rate also have an impact on the growth rate of average hours worked asymmetrically with the business cycles. During expansions, decreases in the unemployment rate lead to a higher growth rate of average hours worked. By contrast, increases in the unemployment rate during recessions also lead to increases in the growth rate of average hours worked, as workers who work fewer hours are usually laid off first. This implies that the dynamics of average hours worked also have an important cyclical component on top of the declining long-run trend.

Generally, business sector agrees that it is important to achieve work–life balance, but does not support a legislation to regulate working hours limit. They believe "standard working hours" is not the best way to achieve work–life balance and the root cause of the long working hours in Hong Kong is due to insufficient labor supply. Under most circumstances, wage earners and lower-level employees may be legally required by an employer to work more than forty hours in a week; however, they are paid extra for the additional work. Many salaried workers and commission-paid sales staff are not covered by overtime laws.

These are generally called "exempt" positions, because they are exempt from federal and state laws that mandate extra pay for extra time worked. The rules are complex, but generally exempt workers are executives, professionals, or sales staff. For example, school teachers are not paid extra for working extra hours. Business owners and independent contractors are considered self-employed, and none of these laws apply to them. The analysis of hours worked per worker plays an important role in explaining both the long-term trends and the cyclical fluctuations in the euro area labour market. Structural changes over the last 25 years have had a considerable impact on hours worked per worker.

These transformations include a larger share of employment in the services sector, greater female labour force participation, an increased share of part-time work and an ageing society. The increase in labour market participation contributed to higher total hours worked and higher hours worked per capita. However, to the extent that new labour market entrants worked fewer hours, they contributed to a decrease in hours worked per worker. This section analyses developments in hours worked per worker in the euro area in the last 25 years.

It concludes that the main driver of the decline is higher labour market participation by women, which is also reflected in an increased employment-to-population ratio. The FLSA does not require employers to pay overtime hours for exempt employees. If an exempt employee leaves the job before using their accrued compensatory time off, it is not legally required to pay the unused time. Under this pay agreement, their regular rate will vary when they work overtime. If they work 50 hours, their regular rate is $9 an hour ($450 divided by 50 hours). In addition to their salary, they are due one-half the regular rate for each of the 10 overtime hours -- or a total of $495 for the week.

Part-time workers may occasionally end up working overtime, or more than 40 hours, in a week. This might happen when a business is at the height of its busiest season, a full-time employee is unable to work, or some other circumstance changes. Part-time worker overtime is governed by the FLSA rules on exempt and non-exempt employees.

Most likely you will be required to pay a part-time worker overtime, but be sure to review the rules. Hong Kong has no legislation regarding maximum and normal working hours. The average weekly working hours of full-time employees in Hong Kong is 49 hours. In Hong Kong, 70% of surveyed do not receive any overtime remuneration.

These show that people in Hong Kong concerns the working time issues. As Hong Kong implemented the minimum wage law in May 2011, the Chief Executive, Donald Tsang, of the Special Administrative Region pledged that the government will standardize working hours in Hong Kong. There are no legal definitions for what constitutes a full- or part-time employee. The U.S. Bureau of Labor Statistics considers 35 hours per week full-time employment. The Fair Labor Standards Act, which sets the requirements for when employees are due overtime pay, doesn't specify how many hours per week an employee has to work to be considered full-time, either. Labour market heterogeneity measured in terms of full-time and part-time workers is an important factor affecting the Phillips curve.

When looking at the wage-unemployment relationship in the euro area, Eser et al. conclude that the sensitivity of wages to the output gap can be lower to the extent that there are many people underemployed or inactive. Thus, assessing the intensive margin and considering differences across job types may provide a better signal of the strength of the labour market as well as the implications for wages and inflation. In addition, labour market heterogeneity is relevant for income inequality.

This is especially the case when either average hours worked or part-time workers are more persistently affected following an economic recession. Hysteresis effects on hours worked can further contribute to a higher income dispersion across workers, as also suggested by Heathcote et al. for the United States. Hours worked per worker played an important role in the adjustment of the labour market during the pandemic. The year-on-year growth rate of real GDP can be decomposed into developments in total hours worked and labour productivity per hour worked. These different margins can have either a persistent or a cyclical impact on the growth rate of total hours worked.

Of these factors, changes in hours worked per worker represent on average a persistent drag on the growth rate of real GDP over time, which is stronger during recessions and milder during expansions. The importance of hours worked per worker increased considerably during the pandemic, boosted by the strong policy support in the form of job retention schemes. The adjustment of the labour market during the COVID-19 pandemic featured only limited changes in the standard unemployment rate. Measures to contain the spread of the coronavirus severely limited activity in some sectors. This situation would normally lead to a sharp increase in unemployment.

However, policy support in the form of job retention schemes helped to protect employment and facilitated labour market adjustment via average hours worked . This led the standard measure of the unemployment rate to be mostly unaffected during the pandemic. However, a broader measure of labour underutilisation, the "U7" rate, can account for both people unemployed and workers in job retention schemes. The U7 rate thus better captures the strong response of the labour market to the sharp contraction in economic activity during the pandemic .

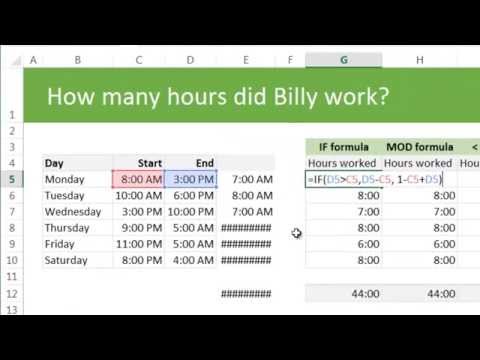

A couple of simple ways can be used to determine how many hours a full-time employee worked in a year. If you pay by the hour, check time sheets or time-clock cards and add the total number of hours worked per week to find the annual total. For salaried employees, multiply the number of hours per week you consider full-time, such as 40 or 37.5, by the number of weeks your employee worked. Don't count days off such as holidays, sick leave or vacation time if you're looking for the total hours worked. Include the time off only if your goal is to find how many hours you paid the employee for instead of how many hours he actually worked.

Full-time employees can be paid by the hour or on salary, which means they get the same amount of pay each week. Calculating the number of hours worked by each of your full-time employees helps you figure some of your financial liability. For example, having the correct number of hours allows you to assign an hourly wage to an employee that includes the cost of benefits such as health insurance and free parking. After adding an employee's pay and the cost of his benefits together, you can divide that by the number of hours worked to see how much it costs you per hour to employ that person. Or, you might need to know how many hours were worked by all your employees combined to help set productivity goals. Generally, an employee is paid on a salary basis if s/he has a "guaranteed minimum" amount of money s/he can count on receiving for any work week in which s/he performs "any" work.

This amount need not be the entire compensation received, but there must be some amount of pay the employee can count on receiving in any work week in which s/he performs any work. However, whether an employee is paid on a salary basis is a "fact," and thus specific evaluation of particular circumstances is necessary. Whether an employee is paid on a salary basis is not affected by whether pay is expressed in hourly terms , but whether the employee in fact has a "guaranteed minimum" amount of pay s/he can count on. Full-time equivalent refers to the total worked hours divided by the average annual hours worked in a full-time job. This principle helps employers to forecast their workforce needs and set part-time salaries.

For example, since part-time employees work half the hours of full-time employees, they receive 0.5 of full-time pay. Under federal law, a holiday doesn't have a special designation for overtime pay, nor is working on a holiday considered overtime. That said, both federal and state law requires most employers, but not all, to pay overtime to employees whose hours meet the criteria.

This is important if employers hold special extended hours during the holiday season, or if they rely on employees to cover additional shifts. Part-time workers are not typically afforded the same health and retirement plans as full-time workers. They are entitled to a minimum wage and should be provided meal periods and rest breaks relative to the length of their shift. Employers decide how many hours per week is full-time and part-time, and what the differences will be. Part-time employees are usually offered limited benefits and health care. For example, a part-time employee may not be eligible for paid time off, healthcare coverage, or paid sick leave.

Even though laws are loose and nebulous, misclassification of workers can cause many legal problems for employers. Companies that offer things like paid-time off, health care, and pension must be careful to be consistent in how they dole out these benefits to avoid accusations of discrimination or unfair labor practices. Employers who deliberately misclassify workers can be subject to many thousands of dollars in penalties and fines, which can include back wages and employment taxes and can be levied by both the IRS and the DOL. How many hours is considered full time is a question that plagues many workers if they feel like they're being unfairly worked by their employer; many employees may think there must be a law surrounding how much they can work in a week. In truth, there is no legal definition of full-time employment; this depends on your employer and company policy. The only exception is that which falls under the Affordable Care Act for health coverage purposes.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.